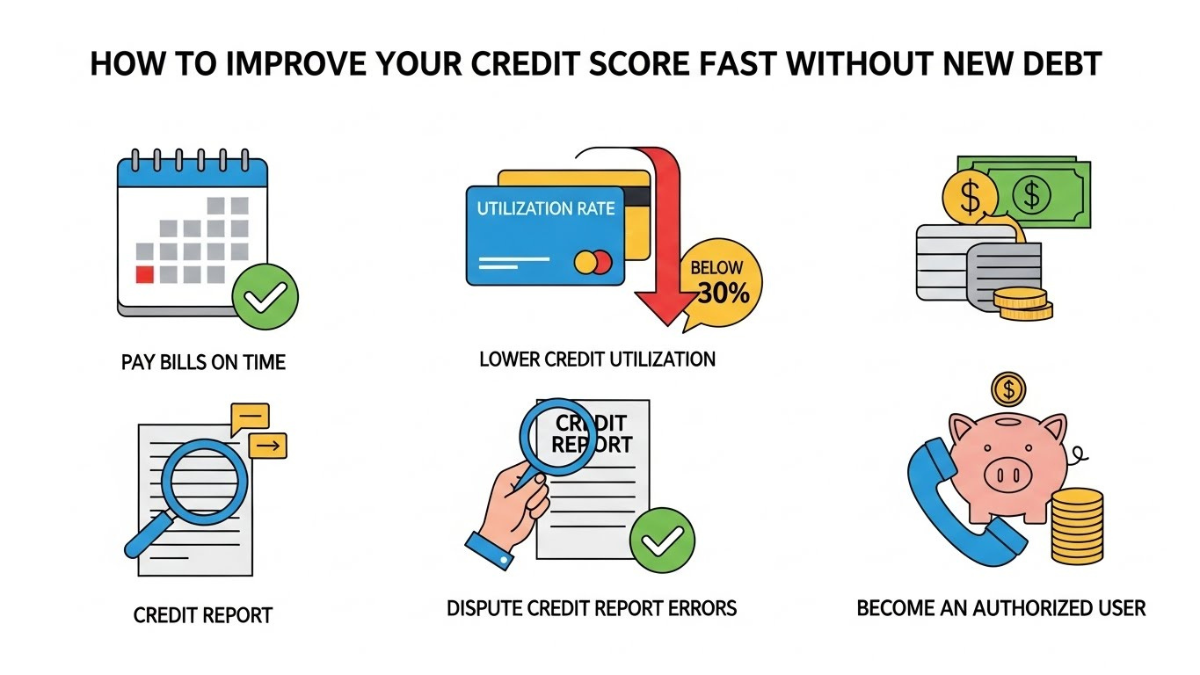

Your financial reputation follows you everywhere, and nothing reflects that reputation more clearly than your credit profile. If your goal is credit score improve fast, the good news is that meaningful progress does not require taking on new debt or opening risky accounts. By focusing on strategic payments, reducing credit utilization, correcting errors, and mastering the rules of credit reporting, individuals can see noticeable improvements in a matter of months rather than years. Understanding how lenders interpret your financial behavior is the key to unlocking rapid results.

Most people believe that fixing credit takes forever. In reality, credit scores respond quickly when the right actions are taken consistently. Whether preparing for a mortgage, car loan, rental approval, or business financing, the path to credit score improve fast begins with clarity and discipline.

Why utilization is the fastest lever for credit improvement

One of the most powerful drivers of credit score improve fast is controlling credit utilization. Utilization measures how much of your available credit you are using at any given time. Even if you make all your payments on time, high utilization signals financial risk to lenders and lowers your score.

Experts recommend keeping total credit utilization below 30 percent, with optimal results appearing under 10 percent. This can be achieved without paying off all balances by strategically redistributing charges, making multiple small payments throughout the month, and requesting credit limit increases without new borrowing.

When utilization drops, credit scoring models often respond within weeks, making this one of the fastest methods to achieve credit score improve fast.

Mastering payment behavior for maximum impact

While utilization creates fast movement, consistent payments create lasting improvement. Payment history accounts for the largest share of your credit score. One missed payment can undo months of progress, while a streak of on-time payments steadily rebuilds lender confidence.

High-impact payments strategies include:

- Setting automatic minimum payments on every account

- Paying balances before statement closing dates

- Making multiple payments per billing cycle

- Prioritizing accounts closest to delinquency

These behaviors accelerate credit score improve fast while strengthening long-term financial stability.

Eliminating errors that silently destroy your score

A surprising number of credit profiles contain damaging errors. Incorrect balances, outdated late payments, duplicate accounts, and even fraudulent activity can sabotage your efforts to credit score improve fast. Many consumers never realize these errors exist until they request their credit reports.

Below is a simple breakdown of common credit errors and their impact:

| Error Type | How It Affects Credit | Correction Time |

|---|---|---|

| Late payment wrongly reported | Severe score drop | 30–60 days |

| Incorrect balance | High utilization | 15–30 days |

| Duplicate account | Artificial debt increase | 30–45 days |

| Closed account listed as open | Lowers score | 15–30 days |

| Fraudulent account | Major damage | 30–90 days |

Disputing and removing errors through proper credit reporting channels often produces dramatic improvements in a short time.

Understanding credit reporting and score timing

To credit score improve fast, you must understand how credit reporting works. Creditors typically report balances and payments once per month. This means your actions today may not appear on your credit report until the next reporting cycle. Strategic timing of payments before statement dates ensures lower reported utilization, accelerating score increases.

Monitoring your reports helps confirm that corrected errors, updated balances, and consistent payments are being accurately reflected. When credit reporting aligns with your actions, progress becomes predictable and measurable.

Building momentum without new debt

The most powerful aspect of credit score improve fast is that it requires no new loans, no new cards, and no financial risk. It is purely about optimizing the data lenders already see. Through disciplined payments, smart utilization control, aggressive removal of errors, and mastery of credit reporting, your score becomes a tool you actively manage rather than a mystery you fear.

Over time, these habits not only raise your credit score but also improve interest rates, loan approvals, insurance premiums, and financial opportunities.

Conclusion: control the system, control your future

Achieving credit score improve fast is not magic — it is strategy. When you control utilization, protect payments, eliminate errors, and understand the mechanics of credit reporting, you gain full command of your financial profile. With consistency and precision, the improvements you seek can arrive far sooner than you ever imagined.

FAQs

How quickly can I improve my credit score?

With proper utilization control and on-time payments, many people see noticeable improvement within 30–60 days.

What is the most important factor for fast improvement?

Lowering credit utilization delivers the fastest impact on credit score improve fast.

Should I open new accounts to improve my score?

No. You can achieve credit score improve fast without opening new accounts by optimizing existing data.

How often should I check my credit report?

Review credit reporting at least once per quarter to catch errors early.

Do disputes really work?

Yes. Removing verified errors can significantly increase your score within one or two reporting cycles.

Click here to learn more