Today, your credit score affects almost every important financial decision. Whether you want a loan, credit card, mortgage, car finance, business funding, or even better interest rates, your credit score plays a powerful role. A strong credit score shows lenders you are responsible, trustworthy, and capable of handling money well. On the other hand, a weak credit score makes borrowing expensive, stressful, and sometimes impossible. Understanding how CIBIL, utilization, payment history, and your credit report work together helps you build a stronger financial future. When you know what to improve, your credit score can increase faster than you think.

Understanding What A Credit Score Really Means

A credit score represents your financial reliability based on your past and current borrowing behavior. Financial institutions, including banks and lenders, check CIBIL or other similar agencies to understand how you handle credit. If your payment history is strong, your utilization is controlled, and your report shows responsible activity, your credit score stays high. If these areas are weak, your credit score drops. Many people ignore their credit score until they face loan rejection or high interest rates, but maintaining it early makes life financially easier.

People value a strong credit score because it:

- Improves loan approval chances

- Reduces interest rates

- Strengthens financial credibility

- Builds trust with lenders

- Reflects responsible payment history and disciplined utilization

Understanding these basics is the first step to improving your credit score.

Payment History And CIBIL: The Most Important Credit Score Factors

Your payment history is one of the biggest contributors to your credit score. Paying credit card bills, EMIs, and loans on time shows lenders that you are disciplined. Missed, delayed, or partially paid bills immediately harm your credit score. Agencies like CIBIL track every payment movement and update your standing regularly. Even one missed payment can stay in your report for years and damage your credibility. This is why regular, timely payment history is essential.

Strong habits to improve payment history and strengthen your credit score include:

- Paying bills before the due date

- Setting reminders or auto-pay options

- Avoiding unnecessary delays

- Clearing pending dues quickly

- Reviewing CIBIL updates regularly

When your payment history is strong, your credit score naturally improves and stabilizes.

Utilization And Credit Report: What Lenders Look At Closely

Many people do not realize how important utilization is for a credit score. Utilization refers to how much of your available credit you actually use. If your credit card limit is high but you constantly use most of it, your credit score may drop. Ideally, your utilization should stay below 30 percent to show lenders that you do not depend excessively on credit. Alongside utilization, your credit report also holds huge importance. Your report contains all borrowing details, past loans, active cards, payment history, and overall behavior.

Below is a helpful clarity table showing how credit score connects with CIBIL, utilization, payment history, and report:

| Element | Role In Credit Score |

|---|---|

| CIBIL | Tracks and rates your credit standing |

| Payment History | Shows responsibility and discipline |

| Utilization | Reflects how wisely you use credit |

| Report | Displays complete financial record |

| Consistency | Keeps score stable long term |

These elements together build the true strength of your credit score.

Checking Your Report And Correcting Errors

One powerful yet often ignored step in improving a credit score is reviewing your credit report regularly. Errors sometimes appear in CIBIL records, such as incorrect outstanding amounts, wrongly reported late payments, or accounts that do not belong to you. These mistakes can significantly damage your credit score. By checking your report, you can identify these issues and request corrections. This instantly improves your credit score and protects financial credibility. Always ensure your personal information, loan records, payment history, and utilization details are correct in your report.

Helpful steps for handling your report include:

- Download your credit report regularly

- Review personal details carefully

- Check loan and card information accuracy

- Report incorrect data to CIBIL

- Track improvements in your credit score

Taking control of your report leads to stronger financial confidence.

Why Building A Strong Credit Score Changes Your Financial Future

A good credit score is more than just a number; it is financial strength and opportunity. When your payment history remains strong, your utilization stays balanced, your CIBIL record is clean, and your report is accurate, every financial process becomes smoother. You receive faster approvals, better interest rates, higher credit limits, and stronger negotiating power. Instead of financial stress, you experience financial control. Protecting your credit score ensures long-term stability and opens doors to opportunities like business investments, property loans, and financial independence.

Conclusion

Your credit score is a powerful financial tool that deserves careful attention. By maintaining a strong payment history, managing utilization wisely, checking your report regularly, and monitoring CIBIL updates, you can build a strong and reliable credit score. These simple yet disciplined habits lead to faster approvals, better rates, and long-term financial strength. A healthy credit score is not only about today; it shapes your financial future with confidence and stability.

FAQ

How is a credit score calculated?

Your credit score is calculated based on payment history, utilization, loan behavior, and details recorded in your report by CIBIL and other agencies.

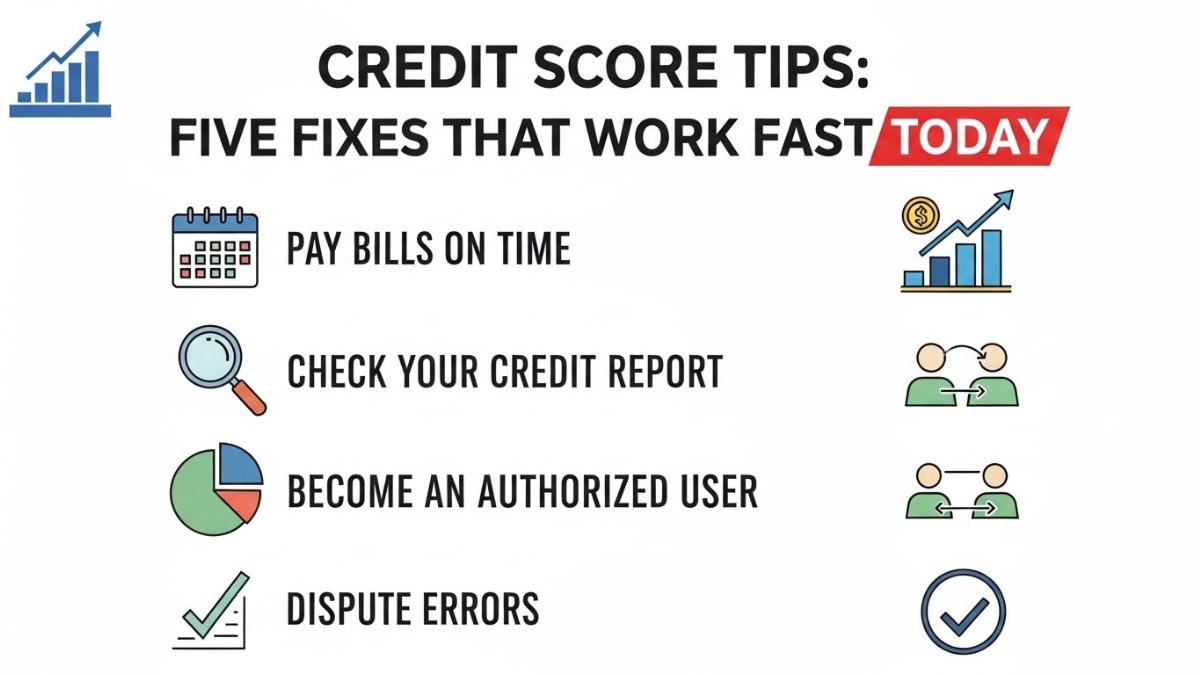

How can I quickly improve my credit score?

Pay bills on time, reduce utilization, correct errors in your report, and maintain strong payment history to improve your credit score effectively.

Why is utilization important for credit score?

Utilization shows how much credit you use compared to your limit. High utilization negatively affects your credit score, while controlled usage improves it.

Should I check my CIBIL report regularly?

Yes, reviewing your CIBIL report frequently helps spot mistakes, track payment history, monitor utilization, and protect your credit score from unnecessary damage.

Click here to learn more